Offshore Trust – What You Should Understand Before Creating One

Offshore Trust – What You Should Understand Before Creating One

Blog Article

Understanding the Key Use an Offshore Trust Modern Financial Strategies

What Is an Offshore Trust?

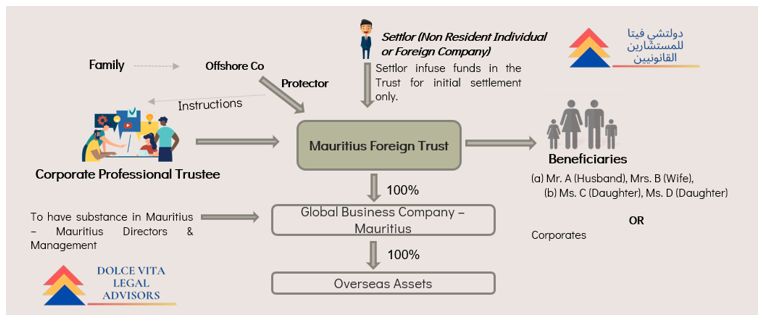

An offshore trust fund is a lawful plan where an individual, called the settlor, places assets right into a trust fund managed by a trustee in a foreign jurisdiction. offshore trust. This configuration enables you to separate your assets from your individual ownership, providing a degree of privacy and control. Normally, you pick a trustee that manages the trust fund according to the terms you establish, making certain that your desires are followed.You might use an offshore count on for various functions, such as estate planning or handling investments. By putting your assets in an international jurisdiction, you can frequently gain from regional legislations that could be extra desirable than those in your house country. This depend on structure can also provide you versatility, allowing you to define exactly how and when beneficiaries receive their assets. On the whole, an offshore depend on can be a strategic device to aid you handle your riches successfully while sticking to your objectives

Asset Protection Advantages

While many individuals look for wide range accumulation, protecting those assets from possible threats is just as vital. An offshore trust can be a powerful device in this regard. By placing your properties in an offshore trust fund, you develop a legal barrier in between your wealth and possible creditors or legal insurance claims. This makes it substantially harder for anyone to access those possessions, providing peace of mind.Additionally, offshore trusts can guard your wealth from political instability, financial slumps, or unfavorable regulative modifications in your home nation. You get the flexibility to choose a jurisdiction with strong asset security legislations, which can further secure your assets from litigation or unforeseen claims.Ultimately, utilizing an offshore depend on for asset protection permits you to concentrate on expanding your wide range, recognizing that your monetary foundation is protected against unanticipated risks. It's a tactical action that boosts your general economic resilience.

Estate Preparation and Wide Range Transfer

When planning your estate, incorporating an overseas count on can substantially boost your wealth transfer methods. By establishing this sort of depend on, you can efficiently safeguard your properties while assuring they reach your designated beneficiaries. Offshore trusts offer a protected environment for your wealth, securing it from prospective financial institutions and lawful claims.You'll additionally gain adaptability in just how you disperse your properties, enabling you to set specific conditions for inheritance. This is particularly beneficial if you intend to handle just how and when your heirs get their inheritance, assisting to ensure they're economically responsible.Additionally, the personal privacy supplied by overseas counts on can secure your estate from public analysis. This suggests your wealth transfer plans remain discreet, protecting your household's tradition. Generally, an overseas count on can simplify your estate planning procedure, making it a crucial device for preserving wealth throughout generations.

Tax Obligation Effectiveness and Reduction Techniques

When it involves optimizing your wide range, overseas trust funds provide considerable tax deferral advantages that can boost your financial technique. You can likewise take advantage of possession defense devices to protect your investments while participating in international tax planning to reduce responsibilities. Comprehending these techniques can be a video game changer for your economic future.

Tax Obligation Deferment Benefits

Offshore depends on can supply significant tax deferral advantages, enabling you to maximize your wealth without dealing with prompt tax responsibilities. By placing assets within an offshore trust, you can defer taxation on income and resources gains up until you take out those funds. This means your financial investments can grow without the worry of yearly taxes, enhancing your overall returns. Furthermore, you get versatility in timing your circulations, enabling you to purposefully intend withdrawals when tax prices might be lower for you. This technique not just preserves your riches however likewise aligns with your long-lasting monetary objectives. Eventually, utilizing an overseas depend on can be a smart relocate your tax obligation efficiency strategy, providing you much more control over your financial future.

Possession Defense Mechanisms

Numerous people look for efficient property security systems to safeguard their wide range from prospective lenders and legal claims. By developing an offshore depend on, you can develop an obstacle between your properties and any type of feasible lawful hazards. These trusts can help secure your riches from suits and insolvency, as properties held within them are commonly considered separate from your individual estate.Additionally, offshore trust funds permit you to designate a trustee who takes care of the assets, further distancing you from straight possession. This framework not only improves security but can additionally deter financial institutions from going after insurance claims versus your possessions. Ultimately, making use of an overseas count on is a calculated transfer to ensure your monetary security while keeping versatility in managing your riches.

International Tax Planning

As you navigate the complexities of international finance, leveraging global tax obligation preparation can greatly improve your wealth administration strategy. By using offshore depends on, you can properly reduce tax obligation responsibilities and optimize your assets' growth potential. These trusts permit you to make the most of positive tax obligation territories, potentially decreasing your revenue and funding gains taxes.You can structure your investments tactically, making sure that you're certified with neighborhood regulations while maximizing your returns. Furthermore, overseas trust funds offer chances for tax deferment, suggesting you can maintain more of your profits benefiting you with time. With cautious planning, you can safeguard a tax-efficient framework that straightens with your economic objectives, eventually preserving and expanding your wealth throughout boundaries.

Privacy and Privacy Benefits

While you consider your financial strategies, the personal privacy and privacy benefits of offshore trust funds attract attention as engaging factors to discover this option. By developing an offshore trust, you can substantially enhance your monetary privacy. These trusts frequently give a layer of defense versus unwanted analysis, permitting you to handle your possessions discreetly.In many jurisdictions, offshore trusts take advantage of stringent privacy regulations that make it tough for 3rd parties to access your financial details. This implies your properties can be secured from public records, decreasing the danger of undesirable focus. Additionally, the privacy supplied can assist secure you from possible lawful disputes or insurance claims versus your assets.Ultimately, using an offshore count on can provide you satisfaction, knowing your economic issues stay personal. As you develop your economic methods, take into consideration just how this personal privacy can reinforce your total financial protection.

International Financial Investment Opportunities

Exploring worldwide investment possibilities can substantially boost your portfolio and supply accessibility to varied markets. By establishing an overseas trust, you can tap into global assets, currencies, and emerging industries that may not be available in your home country (offshore trust). This diversification lowers danger while potentially increasing returns, as various markets commonly respond in different ways to economic changes.Investing internationally allows you to maximize development in establishing economic situations and hedge versus regional market downturns. You can explore real estate, supplies, bonds, and different investments in various nations, expanding your financial investment horizons.Additionally, overseas depends on can offer tax advantages and help you handle money direct exposure effectively. They can serve as a car to secure your investments from local economic instability. By leveraging these global opportunities, you can purposefully position your properties for long-lasting growth and protection, ultimately leading to a more resilient economic strategy

Selecting the Right Territory for Your Trust fund

When picking the right jurisdiction for your overseas depend on, you have to take into consideration various factors that can greatly impact your Our site financial technique. Initially, take a look at the legal structure; some jurisdictions use stronger asset defense laws than others. You'll also intend to review tax ramifications, as specific places might provide beneficial tax treatment for trusts.Next, consider the political and financial stability of the jurisdiction. A steady atmosphere assurances your assets continue to be safe and secure and obtainable. Don't neglect to investigate the track record of the territory; a well-regarded place can enhance the trustworthiness of your trust.Lastly, think of the management demands and costs associated with establishing and preserving the depend on. A territory with simpler guidelines can conserve you money and time. By very carefully evaluating these variables, you can pick a territory that aligns with your economic goals and provides the finest defense for your assets.

Often Asked Questions

Can I Establish an Offshore Count On Without a Monetary Expert?

Yes, you can establish an overseas trust without an economic advisor, however it's high-risk. offshore trust. You'll require to research legislations, requirements, and laws extensively to guarantee compliance and make educated decisions throughout the procedure

What Are the Prices Linked With Establishing an Offshore Trust Fund?

Establishing up an offshore trust includes prices like establishment charges, legal expenses, and continuous upkeep costs. You'll need to consider these elements meticulously to assure the count on aligns with your economic goals and demands.

Exactly how Does an Offshore Trust Influence My Residency Status?

An offshore count on can affect your residency status by potentially creating connections to an additional jurisdiction. Relying on your home country's tax legislations, you might find on your own subject to various tax obligations or residency needs.

Can I Access Funds in My Offshore Trust Easily?

You can access funds in your offshore trust fund, yet the simplicity depends upon the depend on's framework and jurisdiction. Some counts on enable adaptable withdrawals, while others might enforce constraints, so examine your details terms.

What Occurs if the Offshore Territory Adjustments Its Legislations?

If the offshore jurisdiction alters its regulations, you might deal with constraints or changes in tax obligation ramifications. It's necessary to remain educated and consult your consultant to adjust your method and handle possible risks properly. An overseas count on is a lawful plan where a person, known as the settlor, places properties right into a trust fund managed by a trustee in a foreign territory. Normally, you select a trustee who manages the count on according to the terms you set, making sure that your desires are followed.You may utilize my site an overseas count on for numerous objectives, such as estate planning or taking care of investments. These counts on can help secure your wide range use this link from claims and bankruptcy, as properties held within them are usually considered separate from your personal estate.Additionally, overseas trust funds enable you to designate a trustee who takes care of the assets, additionally distancing you from direct ownership. These counts on frequently provide a layer of defense against undesirable examination, allowing you to handle your possessions discreetly.In lots of territories, offshore trust funds benefit from strict discretion legislations that make it difficult for 3rd celebrations to access your monetary details. You can access funds in your overseas trust, but the ease depends on the trust fund's framework and territory.

Report this page